In the fast-paced world of Forex trading, traders often seek tools that provide an edge in understanding market movements. One such tool, which is both comprehensive and powerful, is the Ichimoku Cloud. Known for its ability to offer insights into market trends, support, and resistance levels, Ichimoku Cloud has gained popularity among traders who want to make more informed decisions. In this article, we’ll dive into how to use Ichimoku Cloud for advanced Forex trading and uncover strategies to enhance your trading performance.

What is the Ichimoku Cloud

At first glance, the Ichimoku Cloud might look complicated, but once broken down, it becomes a practical and highly visual trading tool. Created by Goichi Hosoda, a Japanese journalist, in the late 1960s, the Ichimoku Cloud serves as an all-in-one indicator designed to provide a clear view of market dynamics. Unlike traditional indicators that often require multiple separate analyses, the Ichimoku Cloud encapsulates various components into a single framework, offering traders insights into potential support and resistance levels, market trends, momentum, and trade signals. This visual tool can help both novice and experienced traders understand where the market is headed, helping them to make more informed decisions.

But why is this indicator so effective for Forex trading? The Ichimoku Cloud provides a “bigger picture” of the market, allowing traders to make well-rounded decisions instead of relying solely on price movements. While many indicators focus on price action alone, the Ichimoku Cloud incorporates time and market volatility, which adds depth to its analysis. By observing the relationship between the different components of the cloud and the price action, traders can gauge the strength of trends and identify potential entry and exit points. This ability to look beyond just price data gives traders a strategic advantage, making the Ichimoku Cloud a favored tool in advanced Forex trading.

The Key Components of Ichimoku Cloud

The Ichimoku Cloud consists of five primary components, each contributing to its overall functionality. These components help traders assess the strength of a trend, potential reversal points, and key support or resistance levels. Understanding each element is crucial for effectively utilizing the Ichimoku Cloud in trading strategies. Here’s a closer look at each component:

1. Tenkan-sen (Conversion Line)

The Tenkan-sen, often referred to as the Conversion Line, is calculated as the average of the highest high and the lowest low over the last nine periods. This line represents the short-term price movement and acts as a quick reference for identifying upward or downward trends. When the Tenkan-sen is moving upwards, it indicates that the market is in a short-term bullish phase, suggesting that buyers are in control. Conversely, a downward movement indicates bearish sentiment, suggesting sellers dominate the market.

Traders frequently use the Tenkan-sen in conjunction with other components of the Ichimoku Cloud. For instance, when the Tenkan-sen crosses above the Kijun-sen (Base Line), it generates a bullish signal, prompting traders to consider entering long positions. This crossover can serve as an early indicator of potential price movement, allowing traders to capitalize on short-term trends. However, it’s essential to confirm these signals with other indicators or price action to avoid false breakouts.

2. Kijun-sen (Base Line)

The Kijun-sen, or Base Line, is the mid-point of the highest high and the lowest low over the last 26 periods. This component serves as a more stable reference point for the market’s trend compared to the Tenkan-sen, which reacts more rapidly to price changes. The Kijun-sen can help traders determine potential support and resistance levels; when the price approaches the Kijun-sen, it often acts as a barrier to further price movements.

In trading strategy, the Kijun-sen is often used to confirm signals generated by the Tenkan-sen. For example, if the Tenkan-sen crosses above the Kijun-sen while both are above the Cloud, it reinforces the bullish sentiment, suggesting a stronger upward movement. On the other hand, if the price is below the Kijun-sen, it may indicate a bearish trend, and traders might look for selling opportunities. Understanding the Kijun-sen’s role in confirming trends allows traders to make better-informed decisions based on market momentum.

3. Senkou Span A and Senkou Span B (Leading Spans)

The Senkou Span A and Senkou Span B are two lines that form the Kumo (or Cloud), which is a shaded area on the chart. Senkou Span A is calculated as the average of the Tenkan-sen and Kijun-sen, projected 26 periods ahead, while Senkou Span B is the mid-point of the highest high and lowest low over the last 52 periods, also projected 26 periods ahead. These two spans create the cloud area, which serves as a visual representation of support and resistance levels in the market.

The Kumo is crucial for assessing market conditions. When the price is above the Kumo, it indicates a bullish market sentiment, while a price below the Kumo suggests bearish conditions. The thickness of the Kumo can also provide insights into the strength of support and resistance. A thicker cloud implies stronger support or resistance levels, while a thinner cloud indicates weaker levels. This allows traders to gauge potential price movements based on how close the price is to the cloud and its thickness.

4. Chikou Span (Lagging Span)

The Chikou Span, or Lagging Span, plots the closing price 26 periods back, providing a lagging reference to current market conditions. This component serves as a benchmark against the current price action, helping traders confirm the strength and direction of trends. If the Chikou Span is above the price, it signals bullish sentiment, while if it’s below, it suggests bearish conditions.

Using the Chikou Span in conjunction with the other Ichimoku components offers valuable insights. For instance, if the price is above the Kumo and the Chikou Span is also above the price, it strengthens the bullish outlook, providing traders with additional confidence in their trading decisions. Conversely, if the price is below the Kumo and the Chikou Span is below the price, it confirms bearish sentiment, indicating potential selling opportunities. The Chikou Span acts as a critical component in confirming trend strength and direction, ensuring traders have a comprehensive view of market dynamics.

How Ichimoku Cloud Works in Forex

Now that you know the components of the Ichimoku Cloud, let’s dive into how they work together in Forex trading. This advanced indicator is primarily used for identifying trends and spotting potential reversals, making it an invaluable tool for traders looking to enhance their strategies.

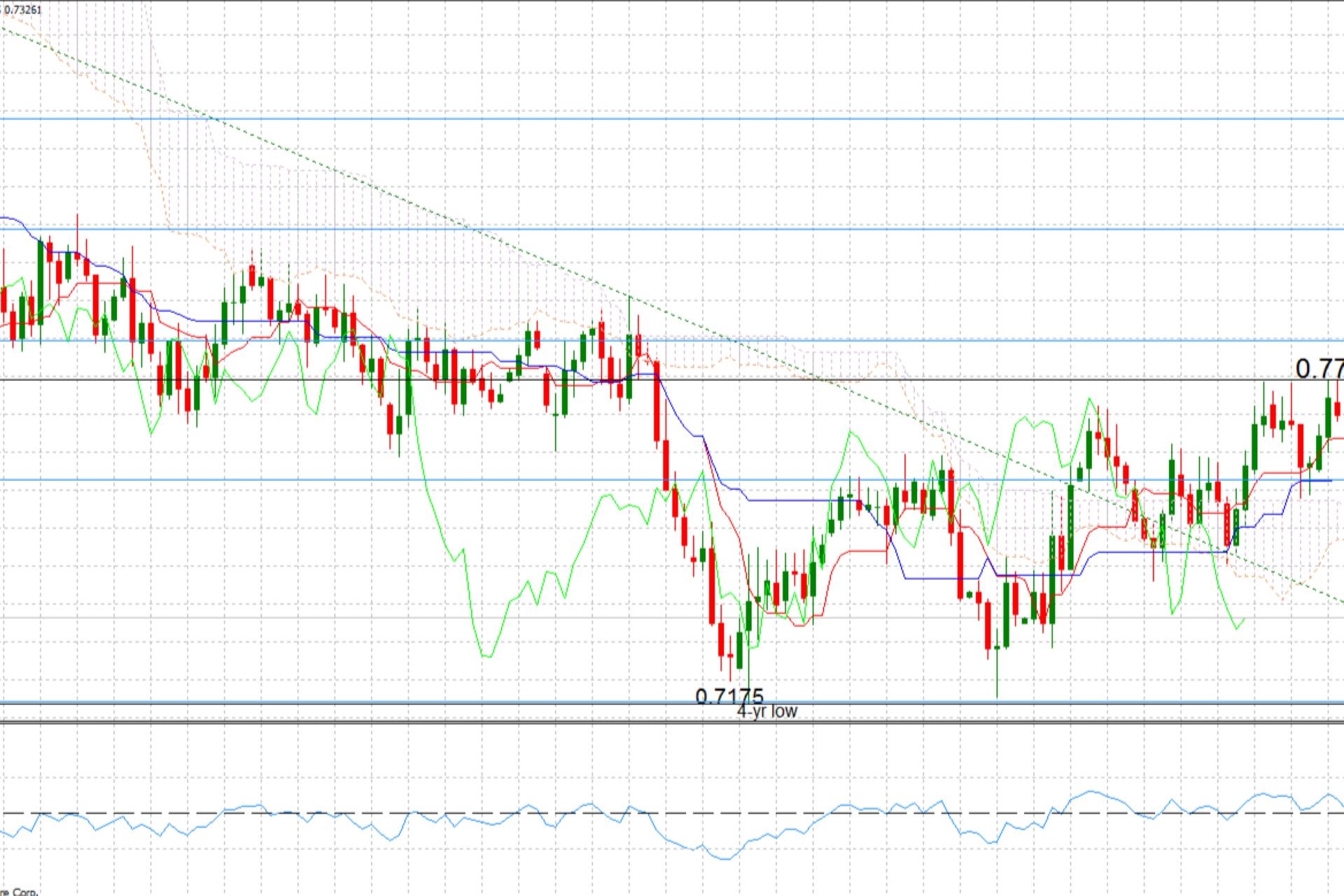

Identifying Trends

The Ichimoku Cloud excels at spotting trends in the Forex market. One of the primary advantages of using the cloud is its ability to visually indicate the market’s direction. When the price is above the Cloud, the market is considered bullish, signaling that buyers are in control and the potential for upward price movement is strong. This setup often prompts traders to look for buying opportunities, as the overall market sentiment aligns with their strategies. Conversely, when the price is below the Cloud, the market is viewed as bearish, indicating that sellers dominate and the likelihood of downward price movement is increased. In this situation, traders may seek to enter short positions or exit long positions to minimize losses.

The thickness of the Cloud also plays a critical role in determining the strength of these trends. A thicker cloud suggests a stronger trend, as it indicates more significant support or resistance levels are at play. This is essential information for traders, as it helps them gauge whether to enter, hold, or exit trades based on market conditions. On the other hand, a thinner cloud indicates weaker trends, which may prompt traders to proceed with caution. In essence, the Ichimoku Cloud not only provides a clear visual representation of market direction but also allows traders to assess the strength of those trends, enabling them to make informed decisions in their trading strategies.

| Market Condition | Price Position Relative to Cloud | Action Recommended |

| Bullish | Price above Cloud | Look for buying opportunities |

| Bearish | Price below Cloud | Consider shorting or exiting longs |

| Strong Trend | Thick Cloud | Enter positions with confidence |

| Weak Trend | Thin Cloud | Exercise caution and monitor closely |

Spotting Potential Reversals

In addition to identifying trends, the Ichimoku Cloud is also effective for spotting potential reversals in the market. One of the key signals traders look for is the crossover between the Tenkan-sen and the Kijun-sen. A bullish crossover occurs when the Tenkan-sen crosses above the Kijun-sen. This event suggests an upward shift in market momentum, signaling traders that it might be a good time to enter long positions. Conversely, a bearish crossover happens when the Tenkan-sen crosses below the Kijun-sen, indicating a possible downward trend. This is often interpreted as a signal to consider entering short positions or exiting long trades to capitalize on the anticipated decline.

These crossovers are crucial for timing entries and exits in trading strategies. However, it’s important to remember that while these signals can be powerful indicators of potential trend reversals, they should not be used in isolation. Traders often look for confirmation from other indicators or price action to validate their decisions. For instance, if a bullish crossover occurs while the price is above the Cloud, it reinforces the signal and indicates a stronger likelihood of an upward movement. In contrast, a bearish crossover occurring below the Cloud may provide a more robust signal for selling. Therefore, combining these crossover signals with other analysis techniques can significantly enhance a trader’s effectiveness in the Forex market.

Ichimoku Cloud Settings for Forex Trading

To utilize the Ichimoku Cloud effectively in Forex trading, understanding its settings is essential. The standard settings for the Ichimoku Cloud are 9-26-52, which indicate the periods used for calculating the various components of the indicator. Specifically, the Tenkan-sen is based on the last 9 periods, the Kijun-sen on 26 periods, and the Senkou Span B on 52 periods. These default settings are designed to work well across many different markets, providing traders with a balanced view of price action and market trends.

While the standard settings are effective for many traders, it’s important to recognize that different trading styles may require adjustments to these parameters. For example, traders engaged in short-term trading strategies may find it beneficial to use smaller settings, such as 7-22-44. These adjustments can lead to quicker signals and allow traders to capitalize on rapid price movements. Conversely, traders focusing on long-term trades may prefer to stick with the default settings or even increase the periods to reduce noise and filter out less significant price movements. Ultimately, tailoring the Ichimoku Cloud settings to align with individual trading goals and styles can enhance its effectiveness, providing clearer insights into market dynamics.

| Ichimoku Setting | Tenkan-sen | Kijun-sen | Senkou Span B | Recommended For |

| Standard | 9 | 26 | 52 | General market analysis |

| Short-term | 7 | 22 | 44 | Quick trades and scalping |

| Long-term | 12 | 26 | 60 | Longer trends and position trading |

By understanding how the Ichimoku Cloud works in Forex, including how to identify trends and spot reversals, along with appropriate settings, traders can make more informed decisions that align with their trading strategies. This comprehensive approach will ultimately enhance their ability to navigate the Forex market successfully.