When diving into the world of Forex trading, one quickly realizes that the landscape is constantly changing. So, how do traders make sense of it all? One of the most valuable tools at their disposal is the currency strength meter. In this article, we’ll explore what currency strength meters are, why they’re essential, and how you can leverage them to enhance your trading strategy.

Forex Trading

Forex trading, or foreign exchange trading, involves buying and selling currency pairs in a global marketplace where currencies are exchanged. This market operates 24 hours a day, five days a week, with trillions of dollars traded daily. As the largest financial market in the world, Forex provides opportunities for investors, traders, and speculators to profit from fluctuations in currency values. Unlike traditional stock markets, Forex does not have a centralized exchange; instead, trading occurs over-the-counter (OTC) through a network of banks, financial institutions, and individual traders. This decentralized nature means that anyone with internet access can participate, making Forex trading accessible to a wide range of participants.

What Are Currency Strength Meters

Currency strength meters are analytical tools designed to measure the relative strength of various currencies against one another. Think of them as navigational aids in the vast sea of Forex trading. Just as a compass guides travelers towards their desired destination, currency strength meters help traders identify which currencies are gaining momentum and which are weakening. By assessing factors such as economic indicators, price movements, and historical trends, these tools provide a comprehensive view of a currency’s performance. For instance, if the meter indicates that the Euro is strong against the US Dollar, a trader might consider buying EUR/USD pairs to capitalize on the trend.

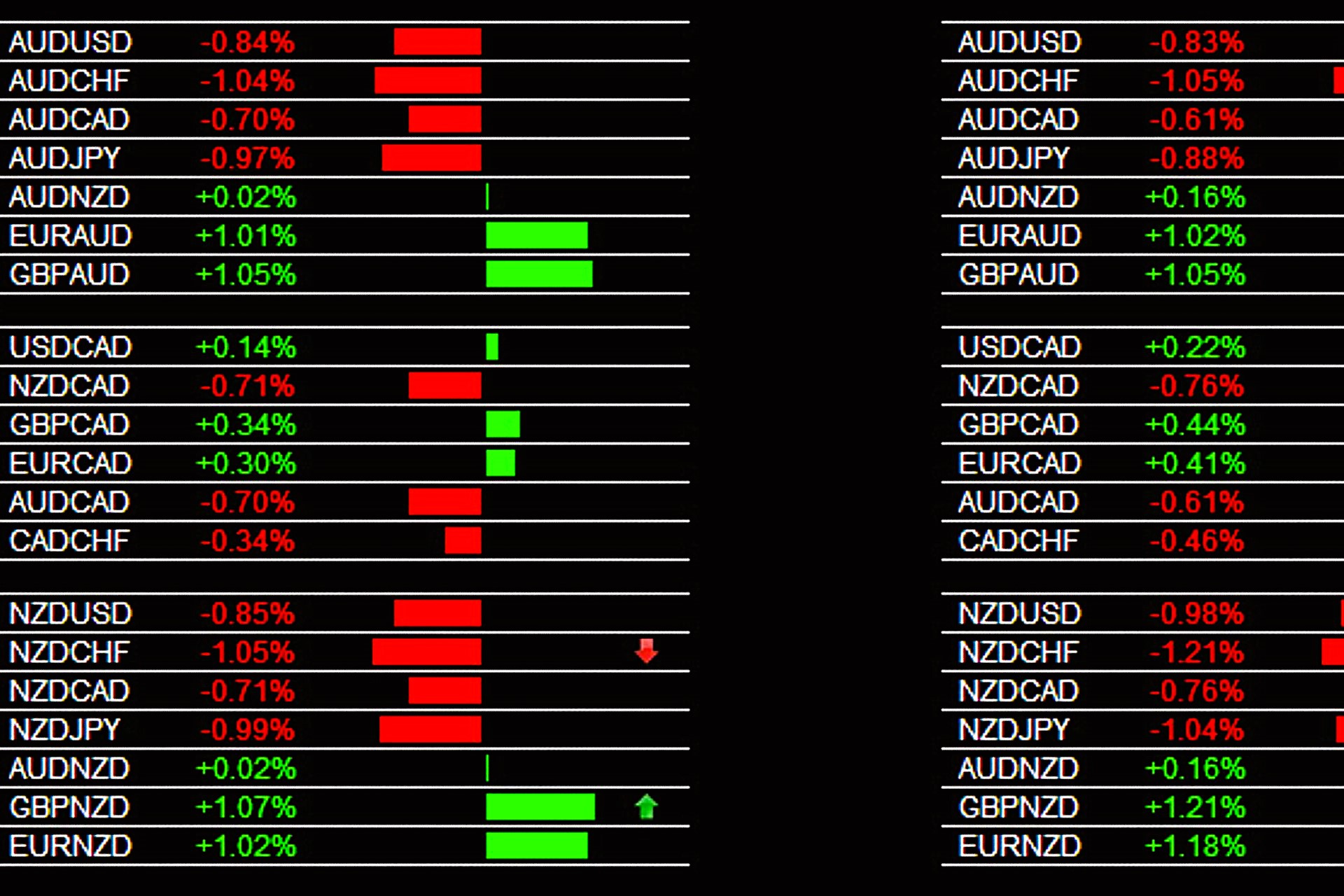

These meters typically display values on a scale, often ranging from 0 to 100, where higher values represent stronger currencies. The intuitive nature of this system allows traders, regardless of their experience level, to quickly assess market conditions. Additionally, currency strength meters often incorporate color-coding or visual graphs, making it easier to interpret data at a glance. By leveraging the insights provided by these tools, traders can strategize more effectively, focus on stronger currencies for potential buy trades, and avoid weaker currencies that may lead to losses. Ultimately, currency strength meters are invaluable resources that empower traders to make data-driven decisions in an ever-evolving market.

How Currency Strength Meters Work

Currency strength meters are essential tools for traders looking to navigate the complex landscape of the Forex market. They analyze and present data about the relative strength of various currencies, offering insights that can greatly influence trading decisions. At their core, these meters simplify the process of understanding currency dynamics, allowing traders to identify potential buying or selling opportunities at a glance. By comparing one currency against others, they help highlight which currencies are performing well and which ones are not. This comparative approach is crucial in a market where fluctuations can happen rapidly and unexpectedly.

Measuring Currency Strength

The measurement of currency strength is the fundamental function of currency strength meters. By comparing a specific currency against a basket of other currencies, these meters generate a strength score that reflects the currency’s market performance. The methodology behind this involves analyzing various factors, such as price movements, historical data, and economic indicators. By assessing these elements, currency strength meters offer a real-time snapshot of how currencies are faring against one another.

Here are some key aspects involved in measuring currency strength:

- Price Comparison: The current price of a currency is compared to its historical prices to assess trends.

- Economic Indicators: Metrics such as GDP growth rates, unemployment rates, and inflation figures are considered to gauge the overall economic health influencing currency strength.

- Market Sentiment: Trader sentiment and market speculation can significantly impact currency values; thus, they are monitored as part of the analysis.

- Cross-Currency Analysis: Strength meters typically evaluate a currency’s performance against multiple other currencies, providing a broader context for understanding its strength.

- Scoring System: As previously mentioned, the final strength score is often displayed on a scale of 0 to 100, allowing for easy interpretation of a currency’s relative strength.

This scoring system is akin to measuring physical strength in a gym; if you can lift heavier weights than your peers, you likely possess more strength. Similarly, a currency that consistently demonstrates higher value compared to others is recognized as stronger. By simplifying this process, currency strength meters allow traders, whether experienced or novice, to quickly assess market conditions and make informed trading decisions.

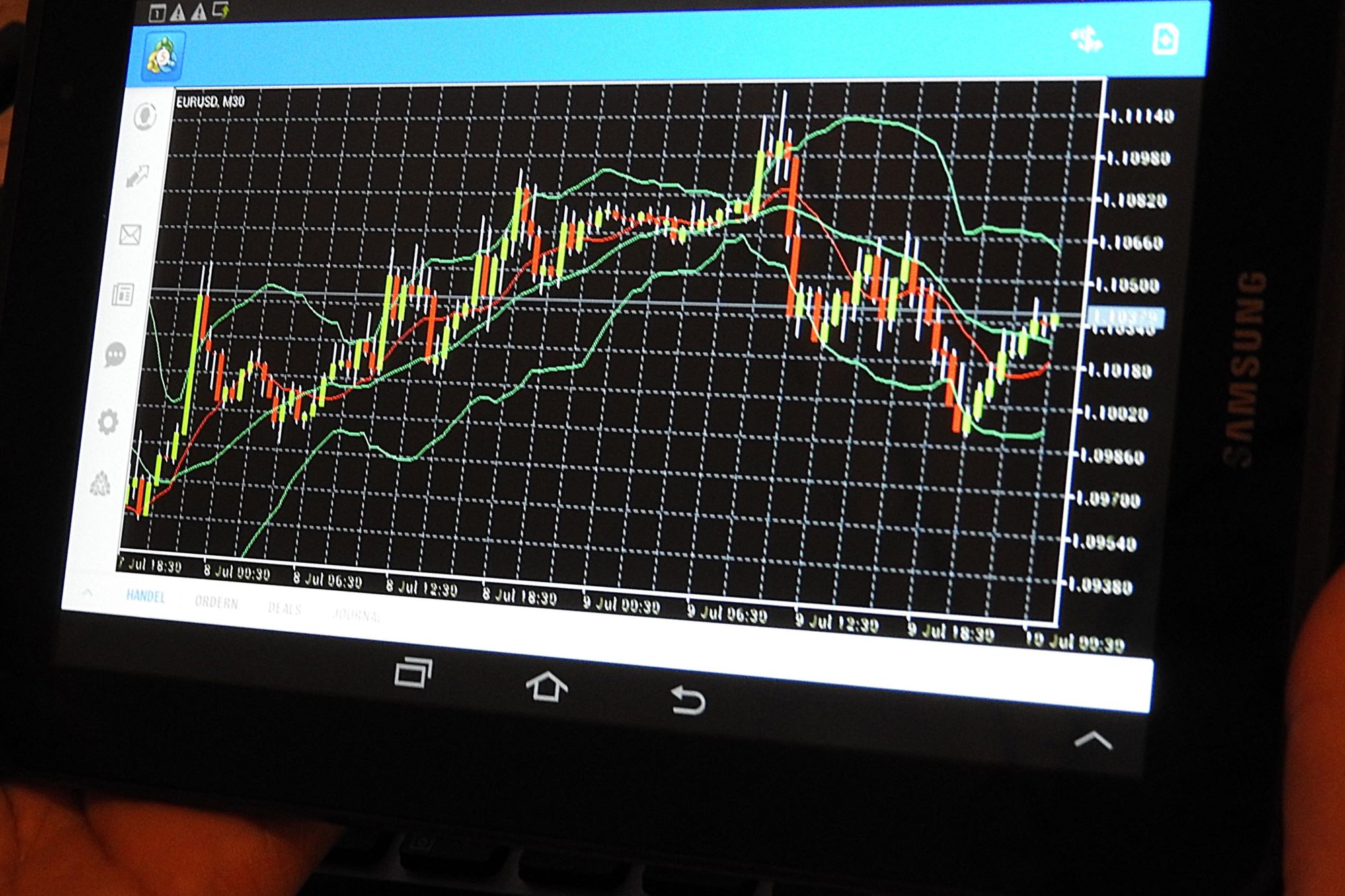

The Role of Technical Indicators

Technical indicators play a significant role in the functionality of currency strength meters. Many of these meters integrate various technical analysis tools to enhance their data interpretation capabilities. These indicators are mathematical calculations based on price and volume data, helping traders identify trends, potential reversal points, and market momentum. By utilizing a combination of technical indicators, currency strength meters provide a more comprehensive view of market dynamics, enabling traders to make better-informed decisions.

Here are some of the most commonly used technical indicators in currency strength meters:

- Moving Averages (MA): These indicators smooth out price data over a specific period, helping traders identify the overall trend of a currency. Moving averages can signal whether a currency is in an upward or downward trend, guiding trading decisions accordingly.

- Relative Strength Index (RSI): The RSI measures the speed and change of price movements, providing insights into whether a currency is overbought or oversold. This information can indicate potential reversal points, allowing traders to time their entries and exits more effectively.

- Moving Average Convergence Divergence (MACD): This indicator shows the relationship between two moving averages of a currency’s price. It can help traders identify bullish or bearish momentum, offering insights into potential trend reversals.

- Bollinger Bands: These bands consist of a moving average and two standard deviation lines, helping traders assess market volatility. When prices touch the upper or lower bands, it can signal overbought or oversold conditions, prompting potential trading actions.

- Fibonacci Retracement Levels: This tool helps identify potential reversal levels based on the Fibonacci sequence, assisting traders in determining possible support and resistance areas.

By incorporating these technical indicators, currency strength meters enhance the analytical capabilities of traders. The combination of relative strength analysis and technical indicators allows for a more nuanced approach to trading, where traders can identify not just strong and weak currencies but also the right moments to enter or exit trades. Ultimately, the integration of technical indicators into currency strength meters makes them powerful tools for improving trading performance in the ever-changing Forex market.

Why Currency Strength Meters Matter

Currency strength meters are pivotal in the Forex trading landscape, as they provide invaluable insights into market dynamics. One of the primary advantages of using these tools is their ability to help traders identify trends and patterns within the market. For instance, if a currency strength meter indicates that the Euro is gaining strength against the US Dollar, savvy traders might take this as a cue to buy EUR/USD pairs. This early recognition of trends can significantly enhance trading opportunities, allowing traders to capitalize on favorable market movements before they become widely recognized. In the fast-paced world of Forex, where every second counts, the ability to spot trends quickly can be the difference between profit and loss.

Identifying Trends and Patterns

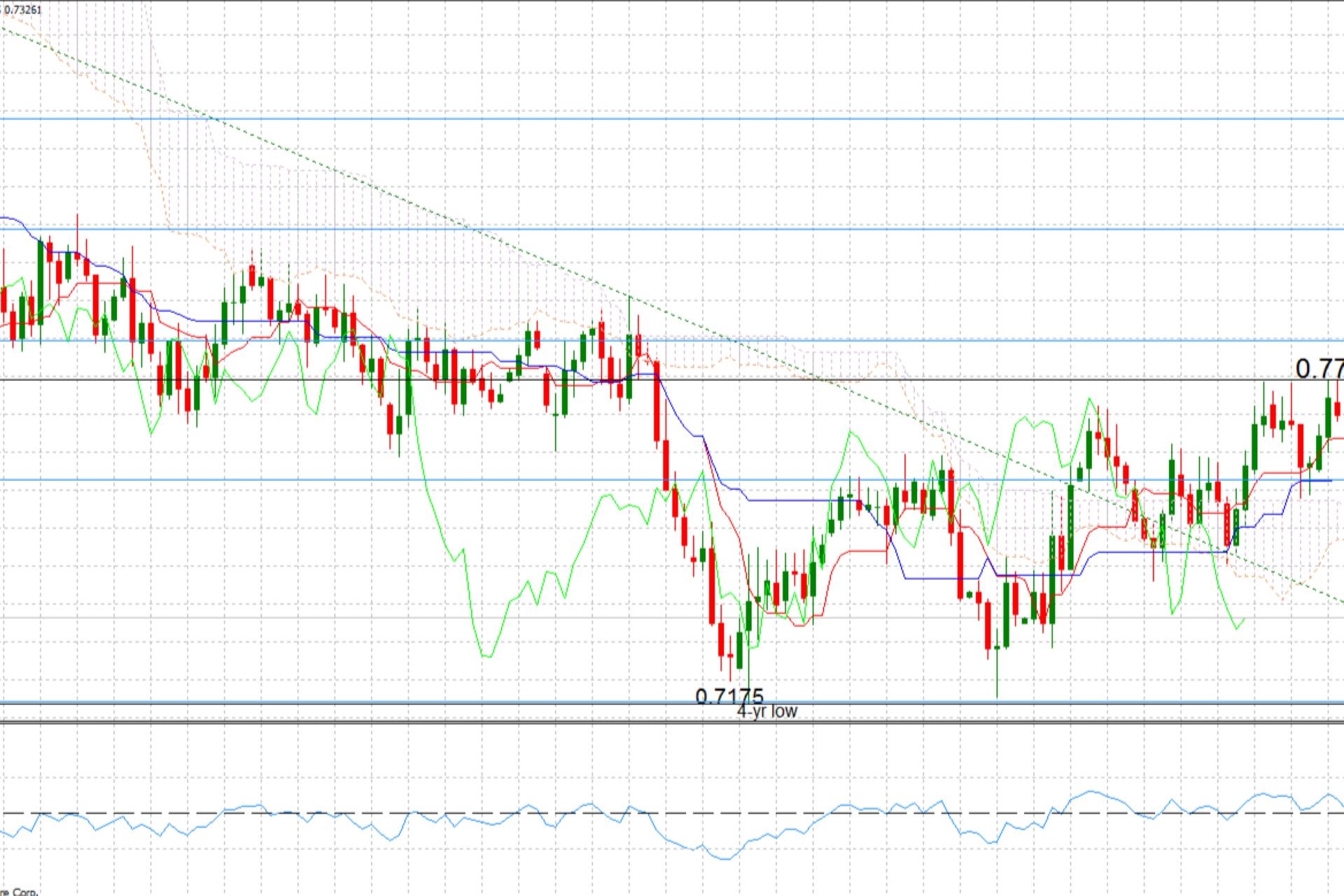

Currency strength meters are essential tools for spotting trends and patterns in the Forex market. By visually representing the relative strength of various currencies, they enable traders to quickly assess which currencies are gaining or losing strength over time. For example, if the meter shows a consistent upward trend for the Euro against the US Dollar, traders might interpret this as a bullish signal. Recognizing such trends early is crucial, as it allows traders to enter positions before the market fully adjusts to these changes. By understanding these patterns, traders can develop strategies that align with the current market sentiment, increasing their chances of making profitable trades.

Moreover, identifying trends isn’t just about recognizing upward movements; it’s also about understanding reversals and consolidations. Currency strength meters can highlight potential shifts in market direction, enabling traders to adjust their strategies accordingly. For instance, if the meter indicates that the USD is starting to weaken against multiple currencies, a trader might consider reducing their long positions on USD-based pairs. By utilizing currency strength meters to identify trends and potential reversals, traders can fine-tune their approaches, allowing them to navigate the market more effectively and improve their overall trading performance.

Making Informed Trading Decisions

In the Forex market, making informed trading decisions is paramount, and currency strength meters serve as invaluable resources in this regard. With real-time data at their disposal, traders can make quick decisions based on the current strength of currencies. This immediacy is particularly beneficial in a market that can shift rapidly due to economic news releases, geopolitical events, or changes in market sentiment. For example, if a currency strength meter indicates that the Australian Dollar is strengthening against the New Zealand Dollar, a trader might act promptly to buy AUD/NZD pairs, capitalizing on the favorable movement.

Furthermore, the ability to interpret data effectively is essential for any trader aiming for success. Currency strength meters simplify complex market information into easily digestible formats, often accompanied by visual aids like graphs and charts. This visual representation allows traders to see trends and make connections more easily than they would by sifting through raw data alone. By leveraging the insights provided by currency strength meters, traders can not only enhance their decision-making processes but also minimize risks associated with hasty or uninformed trades.

Risk Management and Strategy Development

Using currency strength meters can significantly enhance risk management strategies for Forex traders. Understanding which currencies are strong and which are weak enables traders to allocate their resources more effectively. For instance, if a currency strength meter indicates that the Euro is consistently strong while the Japanese Yen is weak, a trader might choose to focus on Euro-based trades rather than Yen pairs. This informed positioning helps minimize exposure to weaker currencies, thus reducing potential losses. Furthermore, by regularly monitoring the strength of various currencies, traders can adjust their positions in response to changing market conditions, allowing for a more proactive approach to risk management.

Moreover, currency strength meters also facilitate the development of more robust trading strategies. By integrating the insights gained from these meters with other analytical tools, traders can formulate comprehensive plans that align with market dynamics. For example, a trader might combine currency strength data with technical analysis indicators to identify optimal entry and exit points. This holistic approach not only improves trading accuracy but also enhances overall performance. By viewing the Forex market through the lens of currency strength, traders can better navigate the complexities of the market and refine their strategies for consistent success.

Types of Currency Strength Meters

Understanding the different types of currency strength meters can help traders choose the right tools for their trading strategies. There are primarily two categories of currency strength meters: absolute and relative. Each type offers distinct advantages and serves different purposes in analyzing currency performance.

| Type of Meter | Description | Use Cases |

| Absolute Currency Strength Meters | Focus on the performance of a specific currency against a basket of other currencies. This type provides a clear view of how one currency performs in isolation. | Particularly useful for traders who primarily trade one currency and want detailed insights into its strength. |

| Relative Currency Strength Meters | Compare multiple currencies against one another. This approach gives traders a broader perspective and helps identify which currencies are trending stronger or weaker. | Ideal for traders looking to capitalize on comparative strengths and weaknesses among several currencies. |

Absolute Currency Strength Meters

Absolute currency strength meters specifically evaluate a single currency’s performance against a group of other currencies. This type of meter is particularly beneficial for traders who focus on a specific currency and want to understand its strength in isolation. By providing a clear score or indicator, absolute meters help traders gauge the relative health of a currency without the noise of comparisons with multiple currencies. For example, if a trader primarily trades the British Pound, an absolute currency strength meter can show how the Pound is performing against the Euro, Dollar, and other currencies, helping them make informed decisions.

Moreover, absolute currency strength meters can enhance a trader’s strategy by highlighting strong and weak currencies in their chosen pair. For instance, if the meter indicates that the Pound is performing exceptionally well compared to the Dollar, a trader might consider entering a long position on GBP/USD pairs. This focused analysis allows for a streamlined approach, enabling traders to concentrate on specific currencies without getting overwhelmed by the broader market. Additionally, the simplicity of absolute meters makes them ideal for novice traders looking to build their understanding of currency dynamics.

Relative Currency Strength Meters

In contrast, relative currency strength meters analyze the performance of multiple currencies against each other, offering traders a broader perspective on market conditions. This comparative analysis is crucial for understanding which currencies are trending stronger or weaker in relation to one another. By highlighting these dynamics, relative currency strength meters enable traders to identify potential trading opportunities across various currency pairs. For example, if the meter shows that the Euro is strengthening against both the Dollar and the Pound, traders might be inclined to buy EUR/USD and EUR/GBP pairs.

The use of relative currency strength meters is akin to comparing apples to oranges; it provides clarity in assessing how different currencies stack up against each other. This broader view can be particularly advantageous in a volatile market, where understanding relative performance can lead to more effective trading strategies. Furthermore, these meters often display visual representations of currency strength, making it easier for traders to spot trends and shifts in market sentiment. By integrating relative currency strength meters into their trading toolkit, traders can enhance their decision-making processes and refine their strategies to capitalize on comparative currency dynamics effectively.