In the world of Forex trading, spotting overbought and oversold conditions is one of the key strategies that traders use to time their entry and exit points. These conditions, when understood and utilized effectively, can help traders make more informed decisions, avoid costly mistakes, and maximize profits. So, how can you accurately identify these conditions and use them to your advantage?

What Does Overbought Mean

An overbought condition occurs when the price of a currency pair rises sharply over a short period, often beyond its fundamental or intrinsic value. This rapid increase can lead to the perception that the currency is overvalued, signaling that a potential market correction may soon take place. Essentially, when a currency is overbought, it indicates that buyers have pushed prices to unsustainable levels, fueled by strong buying momentum or market hype. This situation often arises in response to positive news or bullish market sentiment, where traders continue buying in anticipation of further price appreciation. However, as the currency’s price exceeds its reasonable value, it becomes more susceptible to a pullback or even a reversal.

In an overbought market, traders often begin to worry that the buying trend cannot continue indefinitely. At some point, the market needs to correct itself, either through a consolidation period or a drop in price. Identifying when a currency is overbought is crucial for traders because it offers opportunities to either exit their long positions or prepare for potential short trades. It is worth noting that even if a market is overbought, it doesn’t mean a reversal will happen immediately. Prices can continue rising before eventually falling, which makes timing the market accurately a significant challenge.

Key Indicators of an Overbought Market

- Rapid price movements without a significant correction: When a currency pair experiences a continuous upward trend without a notable pullback, it may signal that the market is becoming overbought. This kind of price movement suggests that buyers are aggressively pushing the price higher, which often leads to exhaustion and a subsequent correction.

- High readings on technical indicators like the Relative Strength Index (RSI) or Stochastic Oscillator: Indicators such as the RSI and Stochastic Oscillator are valuable tools for identifying overbought conditions. For example, when the RSI exceeds 70, it indicates that the asset is overbought. Similarly, a Stochastic Oscillator reading above 80 signals an overbought market. These technical indicators help traders identify potential turning points, especially when they reach extreme levels.

Why is Identifying Overbought and Oversold Conditions Important in Forex

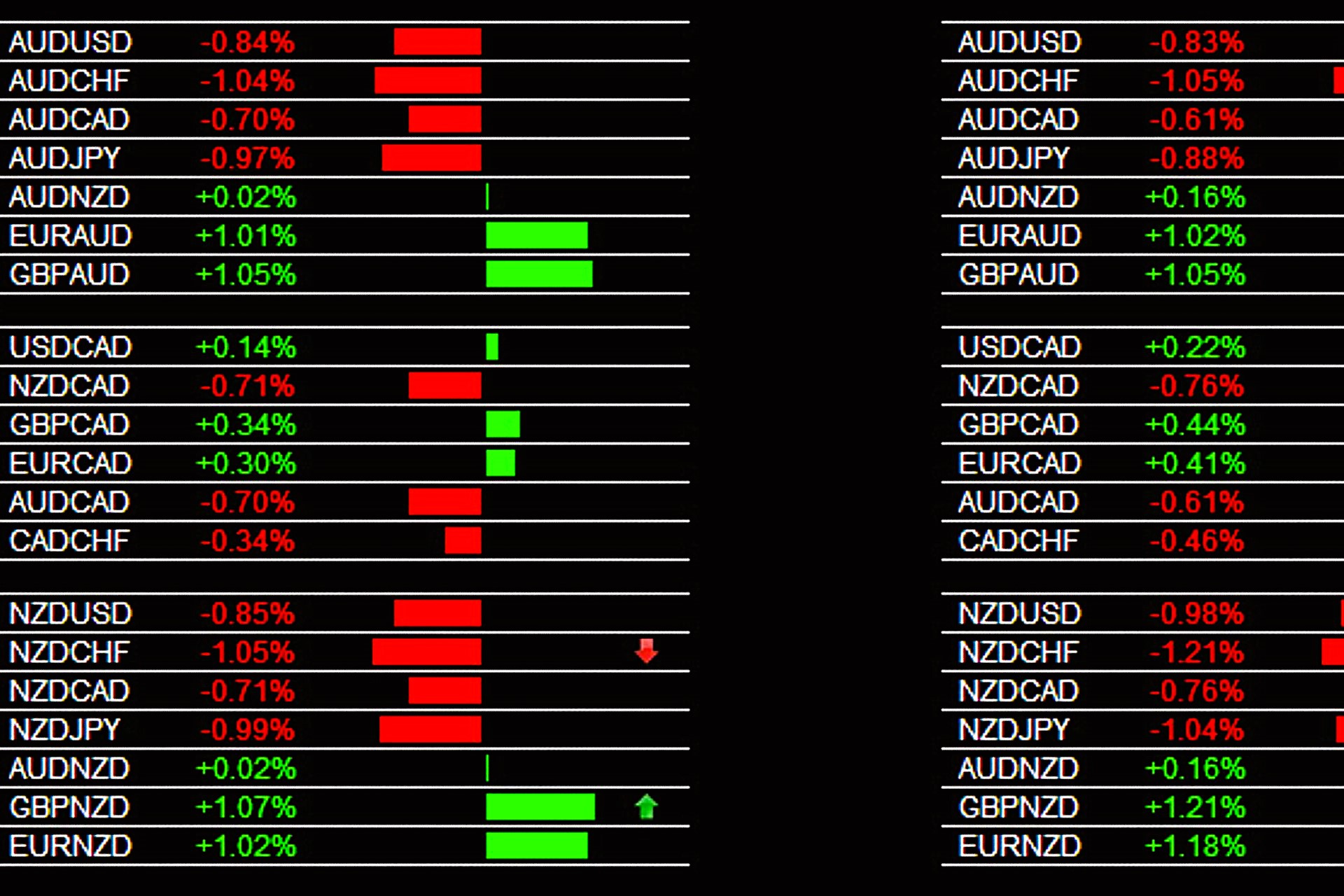

Identifying overbought and oversold conditions is essential for traders looking to maximize their success in the Forex market. These conditions signal when a currency pair may be primed for a reversal, allowing traders to anticipate changes in market direction. When a currency is overbought, the likelihood of a price drop or a market correction increases. Conversely, when a currency pair is oversold, it is more likely to experience a price rally or upward movement. Traders who can effectively spot these conditions gain a significant edge, as they can better time their trades and improve their profitability.

Overbought and oversold signals are particularly helpful in volatile markets where price movements can be unpredictable. By recognizing these conditions, traders can avoid making trades that are too risky or that may result in losses. For instance, entering a long trade in an overbought market could lead to a quick reversal, causing a potential loss. On the other hand, selling in an oversold market might mean missing out on a strong rebound. That’s why knowing how to interpret these conditions can save traders from poorly timed decisions.

Impact on Trading Decisions

- Informed Entry and Exit Points: Understanding overbought and oversold conditions enables traders to make smarter decisions about when to enter or exit the market. In overbought conditions, it may be wise to take profits or even initiate a short position if a correction seems imminent. In oversold conditions, traders may look to enter long positions as the market is likely undervalued, presenting a buying opportunity.

- Managing Risk and Maximizing Profit: By identifying these conditions, traders can manage their risk more effectively. They can avoid getting caught in extreme market conditions that may lead to significant losses. Additionally, traders who correctly identify overbought and oversold markets can maximize their profits by timing their trades in line with market corrections or reversals, thereby capturing gains that others may miss.

Popular Indicators to Identify Overbought and Oversold Conditions

In Forex trading, identifying overbought and oversold conditions is crucial to timing market reversals. Several technical indicators have been developed to help traders assess these conditions, providing insights into whether a currency pair is at an extreme level of buying or selling pressure. Here, we’ll explore three of the most widely used indicators: the Relative Strength Index (RSI), Stochastic Oscillator, and Commodity Channel Index (CCI). These indicators are popular due to their simplicity and reliability in analyzing market momentum and price trends.

1. Relative Strength Index (RSI)

The RSI is a powerful momentum oscillator used to measure the speed and magnitude of a currency pair’s price movements. It operates on a scale from 0 to 100 and is one of the most popular indicators for identifying overbought and oversold conditions. RSI values above 70 typically indicate that the currency is overbought, while values below 30 suggest that it is oversold. This tool is particularly effective for spotting potential market reversals or corrections. Traders often use RSI to confirm entry and exit points, as it helps identify when the market may be poised for a turnaround.

2. Stochastic Oscillator

The Stochastic Oscillator is another widely used technical indicator that compares the closing price of a currency pair to its price range over a set period of time. Like RSI, the Stochastic Oscillator ranges from 0 to 100. Readings above 80 typically indicate overbought conditions, while readings below 20 signal oversold conditions. The oscillator is particularly useful for identifying short-term reversals in the market, making it a favorite among day traders and swing traders. It is known for providing strong signals in ranging markets, where prices oscillate between support and resistance levels.

3. Commodity Channel Index (CCI)

The CCI is designed to measure the deviation of a currency’s price from its average price over a specific period. While not as commonly used as RSI or Stochastic, the CCI is excellent for identifying overbought and oversold conditions, especially in highly volatile markets. CCI values above +100 suggest that the currency is overbought, while values below -100 indicate that it is oversold. This tool is highly versatile and can be used across different timeframes, making it a valuable addition to a trader’s toolkit.

| Indicator | Range | Overbought Signal | Oversold Signal |

| Relative Strength Index (RSI) | 0 to 100 | Above 70 | Below 30 |

| Stochastic Oscillator | 0 to 100 | Above 80 | Below 20 |

| Commodity Channel Index (CCI) | Varies | Above +100 | Below -100 |

- RSI is ideal for detecting general market trends and determining the overall momentum. It helps confirm when a market is either overbought or oversold.

- Stochastic Oscillator works well in identifying short-term price reversals and is particularly useful in range-bound markets.

- CCI excels in volatile markets where price fluctuations are more pronounced, helping to detect extremes that could lead to reversals.

Each of these indicators has its strengths, and traders often combine them to improve accuracy and reduce the risk of false signals. By using them in tandem, traders can better gauge whether a currency is at its peak or nearing a reversal.