In the world of forex trading, finding the right strategies to analyze the market is crucial. One method that has gained popularity is the use of fractals. But what are fractals, and how do they help in forex market analysis? This article will take you step by step through everything you need to know about using fractals in forex trading, helping you enhance your strategies and make better trading decisions.

What is Forex Trading

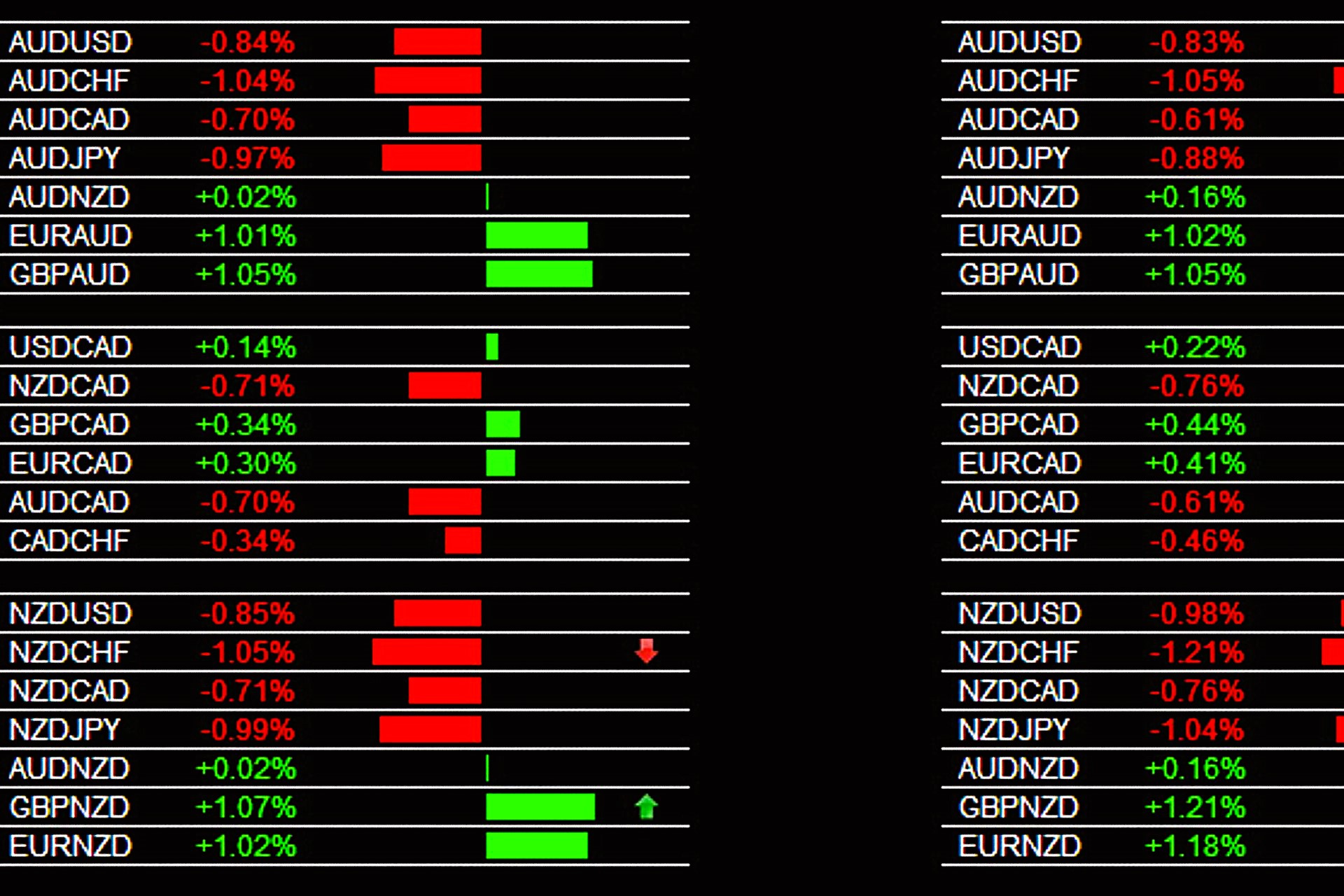

Forex, short for foreign exchange, is the largest and most liquid financial market globally, where currencies are bought and sold. Traders participate in this market by trading currency pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen), aiming to profit from the fluctuations in exchange rates. The forex market operates 24 hours a day, five days a week, allowing for trading opportunities around the clock. Unlike stock markets that focus on shares of individual companies, forex trading involves trading one currency against another, with traders speculating whether a currency will rise or fall in value relative to another.

Success in forex trading is largely based on a trader’s ability to analyze market trends, understand price movements, and make timely decisions. Traders use a variety of tools and strategies to predict market behavior, including technical analysis, fundamental analysis, and sentiment analysis. Technical analysis focuses on studying past price charts and patterns, while fundamental analysis considers economic factors like interest rates, inflation, and political events that might influence a currency’s value. To be effective, forex traders must also manage risks, such as volatility and unexpected price changes, making it a challenging yet rewarding market for those who develop strong analytical skills.

Fractals in Forex

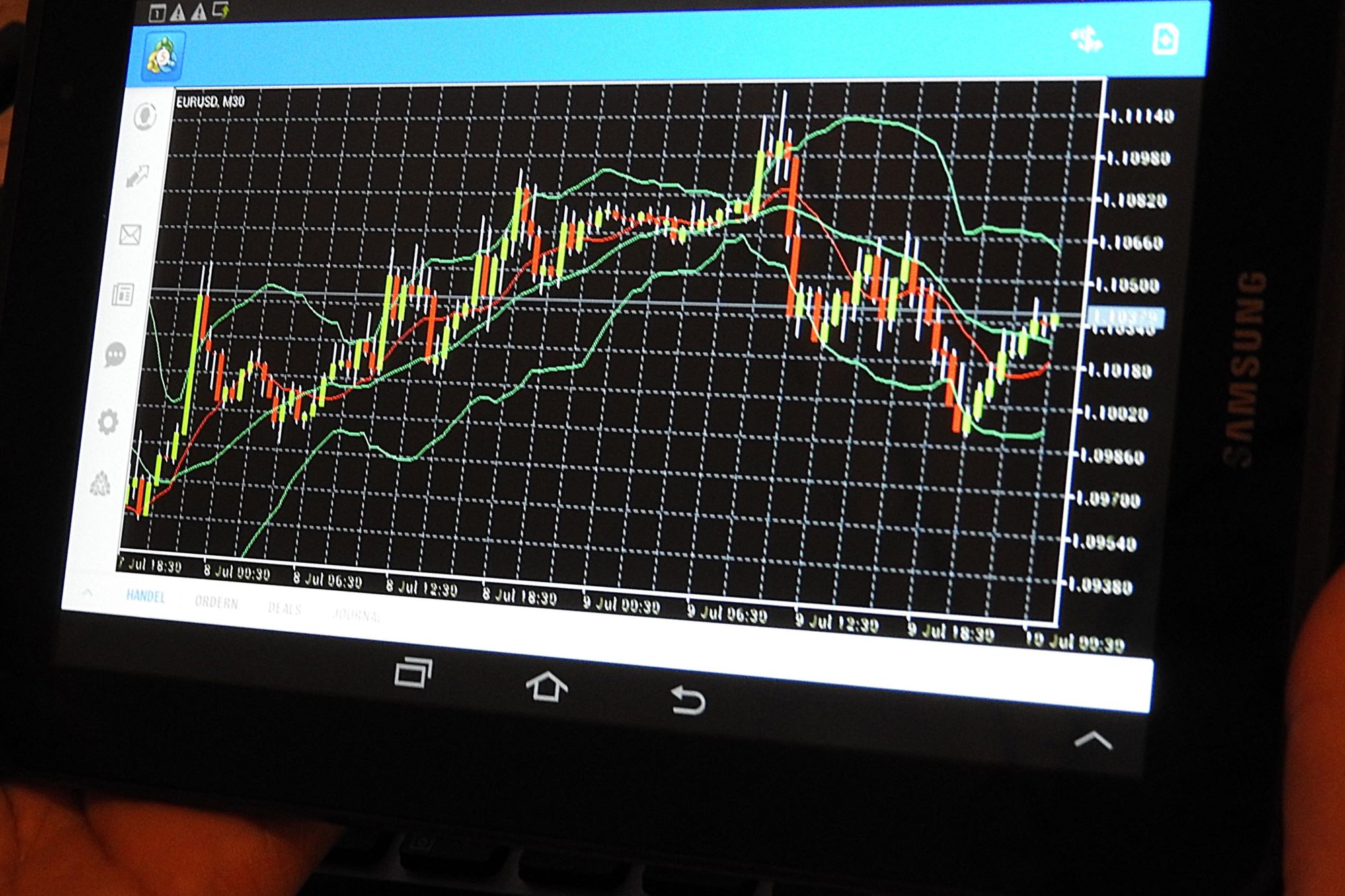

Fractals in forex trading are one of the tools used in technical analysis to identify potential reversals and continuations in price trends. A fractal, in trading terms, refers to a recurring pattern that forms on price charts, helping traders recognize areas where the market may be reversing direction or continuing in the same direction. Fractals are particularly useful for traders looking to pinpoint high and low points on a chart, enabling them to make decisions about when to enter or exit the market. These patterns appear consistently across all timeframes, from one-minute charts to daily charts, making fractals a versatile tool in a trader’s toolkit.

The primary purpose of fractals is to identify turning points in price movements, whether a currency pair is in an uptrend, downtrend, or trading within a range. When fractals are combined with other technical indicators, they become even more powerful, offering additional confirmation to trading signals. For instance, traders may use fractals alongside indicators like moving averages, Bollinger Bands, or the Relative Strength Index (RSI) to confirm whether a market is overbought, oversold, or ready to change direction. This layered approach can improve the accuracy of predictions, helping traders avoid false signals and focus on higher-probability trades.

Why Fractals Are Important in Market Analysis

Fractals are essential in market analysis because they give traders a clear visual indicator of potential reversals in price trends. By identifying these turning points, traders can make more informed decisions about when to enter or exit trades. Since forex markets are constantly fluctuating, knowing when a reversal might occur is critical for maximizing profits or minimizing losses. Fractals help by marking high and low points in a price trend, showing where the market is likely to reverse its direction or continue in the same trend. This is particularly valuable for traders who rely on technical analysis to make their decisions.

In addition to identifying reversals, fractals are also useful when combined with other technical indicators. By doing so, traders can increase the accuracy of their predictions and strengthen their market analysis. For example, a trader might use fractals in combination with trend indicators like moving averages to determine if a price reversal is part of a larger trend or just a temporary fluctuation. This combination of tools helps provide a more comprehensive view of the market, allowing traders to make better decisions and reduce the risk of entering trades at the wrong time.

Key Reasons Fractals Are Important:

- Identifying Trend Reversals: Fractals highlight points on a chart where a trend may be changing direction.

- Combining with Other Indicators: When used with moving averages, RSI, or other tools, fractals improve the accuracy of trend predictions.

- Spotting Market Highs and Lows: Fractals mark important highs and lows in price, making them valuable for setting stop-loss orders or take-profit levels.

- Versatile Across Time Frames: Fractals work on various chart timeframes, from short-term trades to long-term market analysis.

What Are Fractals

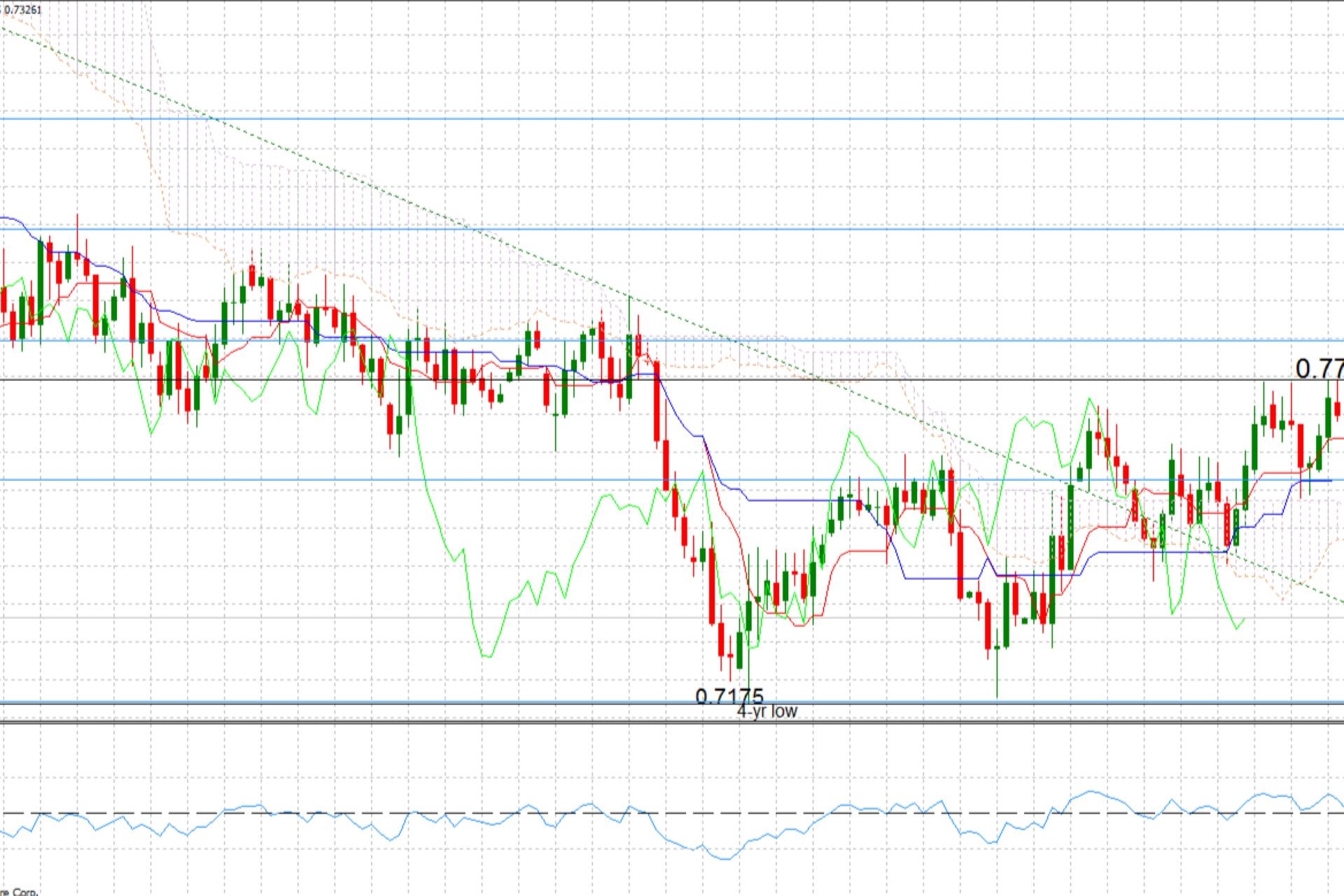

Fractals, in the context of forex trading, are repeating patterns found within the price movement of currencies. In technical terms, a fractal is a pattern composed of five or more bars (candlesticks), where the middle bar stands out as the highest high or lowest low, and the surrounding two bars on either side are progressively lower or higher. This pattern resembles the structure of fractals in geometry, where smaller parts reflect the whole, hence the name. In the forex market, fractals help traders identify points where the market may reverse or continue its trend, offering clues for strategic entry and exit points.

In forex trading, a bullish fractal is formed when the middle candlestick of the five-bar pattern is the lowest point, signaling a potential upward movement in price. Conversely, a bearish fractal occurs when the middle candlestick is the highest point, indicating a possible downward trend. These patterns are commonly used in conjunction with other technical analysis tools, as fractals alone may not always provide a complete picture of market conditions. For traders, the real value of fractals lies in their ability to simplify the identification of key price points amidst the often chaotic movement of the forex market.

How Fractals Appear on Charts:

- Bullish Fractals: The middle candlestick has the lowest low, with two higher lows on either side, indicating a potential upward reversal.

- Bearish Fractals: The middle candlestick has the highest high, with two lower highs on either side, signaling a possible downward movement.

- Five-Bar Structure: The fractal pattern is composed of five bars or candlesticks, with the middle bar being the pivot point for the fractal signal.

- Visual Representation: On most forex trading platforms, fractals are displayed as arrows above or below the price chart, helping traders spot the key points easily.

Origin of Fractal Theory

The concept of fractals originates from chaos theory, which seeks to find patterns and order within systems that appear random and chaotic. Chaos theory studies systems that are sensitive to initial conditions, where small changes can lead to significantly different outcomes. This theory is widely applied in various fields like meteorology, physics, and finance. Fractals, as part of this theory, represent patterns that repeat at different scales, revealing underlying structures in seemingly disordered systems. The concept of fractals demonstrates that even in the most complex, chaotic environments, there are recurring patterns that can help in understanding the system’s behavior.

Fractals were first brought to prominence by the renowned mathematician Benoît Mandelbrot in the 1970s. Mandelbrot discovered that fractals could be found in nature, such as in coastlines, mountains, and clouds, which all display a form of repeating structure at various scales. This idea revolutionized the way scientists looked at complex systems. In finance, traders and analysts have adopted fractal theory to analyze price movements in financial markets. Mandelbrot’s work has provided valuable insights into understanding market fluctuations, especially in identifying patterns in price trends that might seem random but actually follow a fractal-like structure.

Application of Fractals in Financial Markets

Fractals have become a valuable tool in analyzing financial markets, particularly in identifying turning points where price movements may reverse or continue. In financial markets like stocks, commodities, and forex, fractals are used in technical analysis to spot recurring patterns in price charts. These patterns help traders predict potential market movements, offering insight into when to enter or exit trades. For instance, a fractal pattern can signal that a market is likely to reverse from an uptrend to a downtrend or vice versa. This makes fractals highly useful in determining key levels of support and resistance.

One of the reasons fractals are so widely used in financial markets is their adaptability to different timeframes and instruments. Whether a trader is analyzing short-term movements on a one-minute chart or long-term trends on a daily chart, fractals can help identify important points of price action. In addition, fractals are often combined with other technical indicators, such as moving averages or Fibonacci retracements, to enhance their accuracy. This combination provides traders with a more robust system for analyzing market conditions and improving trading decisions. The simplicity and versatility of fractals have made them a popular choice for both novice and experienced traders alike.

How Fractals Work in Forex

| Aspect | Description | Bullish Fractal | Bearish Fractal |

| Pattern Structure | Composed of 5 or more bars, with the middle bar being the highest or lowest | Middle bar has the lowest low; two higher lows on each side | Middle bar has the highest high; two lower highs on each side |

| Indication of Movement | Helps in spotting potential reversals in price trends | Suggests a reversal from a downtrend to an uptrend | Signals a reversal from an uptrend to a downtrend |

| Use in Trading | Fractals are used for determining entry and exit points | Traders may enter long positions when a bullish fractal forms | Traders may enter short positions when a bearish fractal forms |

| Combination with Indicators | Often combined with moving averages, Fibonacci, and oscillators | Used to confirm reversal and trend signals | Combined with other indicators to avoid false signals |

In the forex market, fractals are primarily used to signal potential reversals in price trends or to confirm the continuation of an existing trend. A fractal consists of five or more bars (candlesticks), with the middle bar acting as the pivot point. The pattern is formed when the middle bar either has the lowest low (for a bullish fractal) or the highest high (for a bearish fractal), while the two bars on either side are progressively higher or lower. This five-bar structure creates a simple visual cue that can help traders spot key turning points in the market.

For a bullish fractal, the middle candlestick is the lowest point, with two higher lows on each side. This pattern indicates that a reversal from a downtrend to an uptrend may be about to occur. Traders often use bullish fractals as signals to enter long positions, expecting the price to rise. Conversely, a bearish fractal forms when the middle candlestick has the highest point, with two lower highs on either side. This pattern suggests a potential reversal from an uptrend to a downtrend, making it a signal to enter short positions. However, it’s essential to combine fractals with other indicators, such as moving averages or oscillators, to confirm these signals and avoid false reversals.